Tencent said today that it banked over RMB300 million ($46 million) from bank transfer fees from WeChatPay, almost all of which came from China. Tencent previously disclosed that 200 million user cards were attached to the payment service as of November 2015, thanks to a genius campaign that taps into China’s tradition of sending red envelopes during New Year, but now it said the figure is “safely more than 300 million” while it also gave us clues as to how large its volumes could become.

Tech In Asia tested it out for a day in China and came away reasonably impressed, although it seems there’s room for improvement.

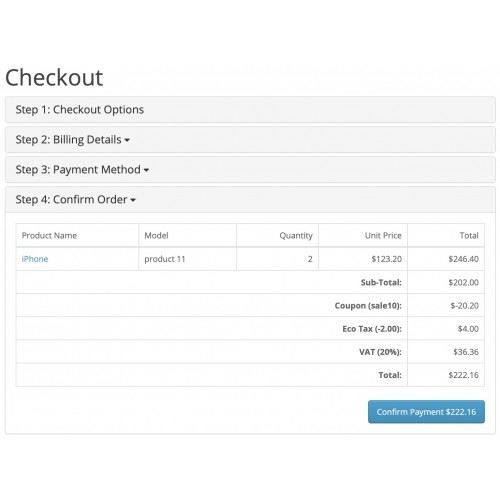

#Wechat payment processing fee foreign Offline#

Payment is another area and over the past year, Tencent has put considerable focus into its China-based service, WeChatPay, which can be used to transfer money between WeChat users (peer-to-peer) and make payments online and with participating offline retailers. Among the other items disclosed, WeChat is now up to 697 million active users worldwide each month having added close to 200 million to that figure over the past year.īeyond text messaging, voice and video calling, the service includes a social network timeline, branded accounts, shopping, games and more.

Tencent, the company behind WeChat (known as Weixin in China), just announced impressive end of year financials ( PDF) that included its highest quarterly revenue growth for three years. It was first to popularize putting brands in chat and integrating third-party services, two trends Facebook-owned WhatsApp and Messenger and others are jumping on, and it looks like payment is the next major focus. WeChat, China’s smash hit chat app, has long been a bellwether for the future of mobile messaging.

0 kommentar(er)

0 kommentar(er)